Should You Diversify?

"Diversification is protection against ignorance. It makes little sense if you know what you are doing." - Warren Buffet

Diversification is touted amongst a lot of academics in the finance world as critical to being successful in the stock market. So why do many of the most successful investors argue that it’s unnecessary?

Why Do People Diversify?

Perhaps the majority of people diversify just because it’s generally seen as the sensible thing to do and advised by financial advisors. You might see the problem here - financial advisors, especially those working in the investing world, have to make things seem complicated to justify the fees they charge to clients.

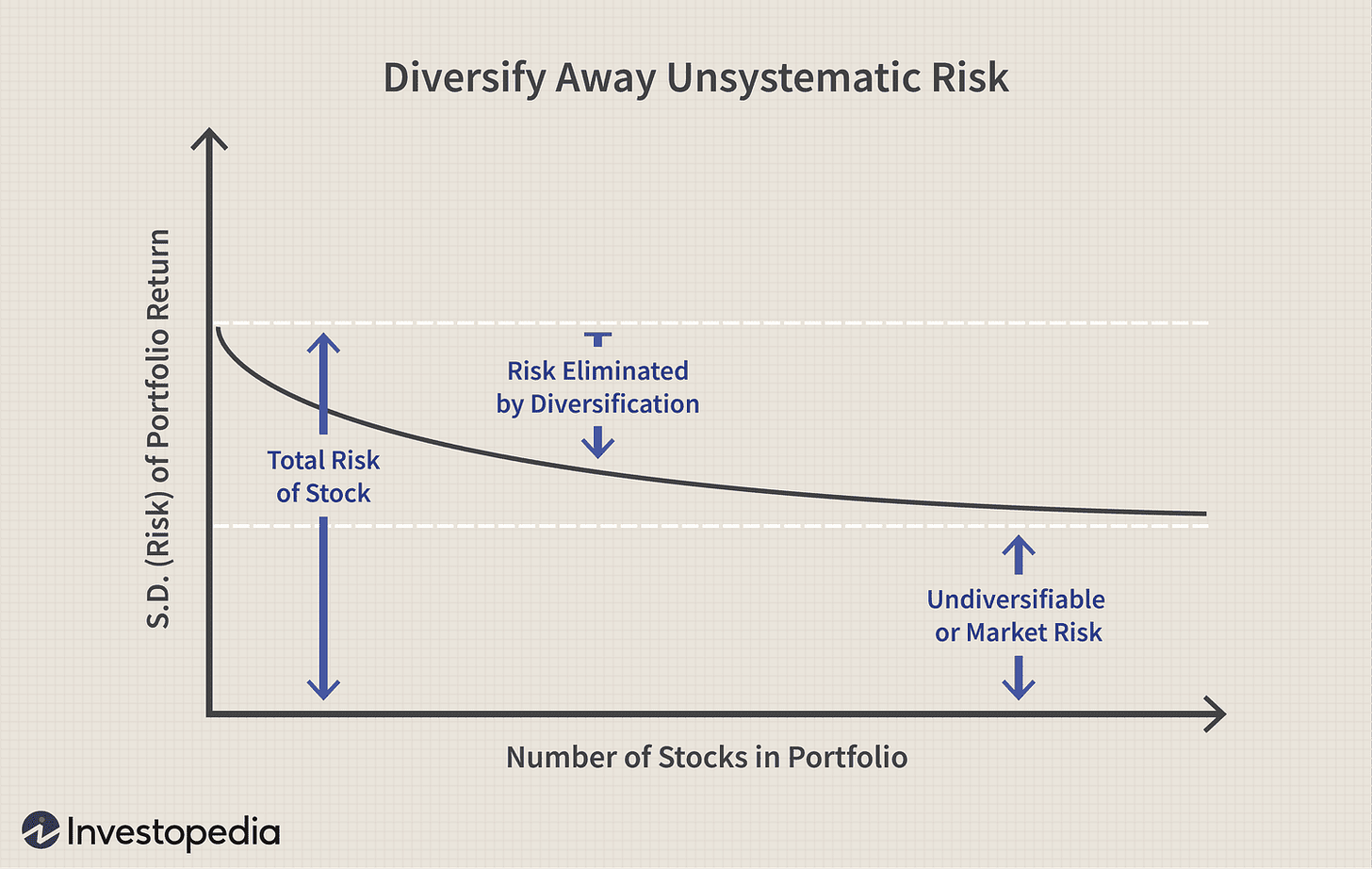

At its core, diversification is rooted in the adage, "don't put all your eggs in one basket." This philosophy encourages investors to spread their capital across stocks, bonds, real estate, commodities, and other asset classes. The rationale is sound: assets will perform differently depending on the economic conditions; when one asset class is declining, another may be rising, thereby stabilizing the portfolio.

Diversification is also taught as a critical part of Modern Portfolio Theory (MPT) in many colleges and universities. Among many famous investors, this is considered a distraction from the central tenet of investing - owning a business. MPT teaches that volatility = risk so a less volatile portfolio is less risky. This isn’t true, risk is just the probability of losing money but unfortunately for academics, and as I talk about more here, this is much harder to quantify.

The Argument Against Diversification

Rich people generally make their money by concentrating their wealth. Entrepreneurs often have all their wealth in a single company, their own which they have total control over. Diversification might be great for maintaining wealth but building wealth really requires concentration.

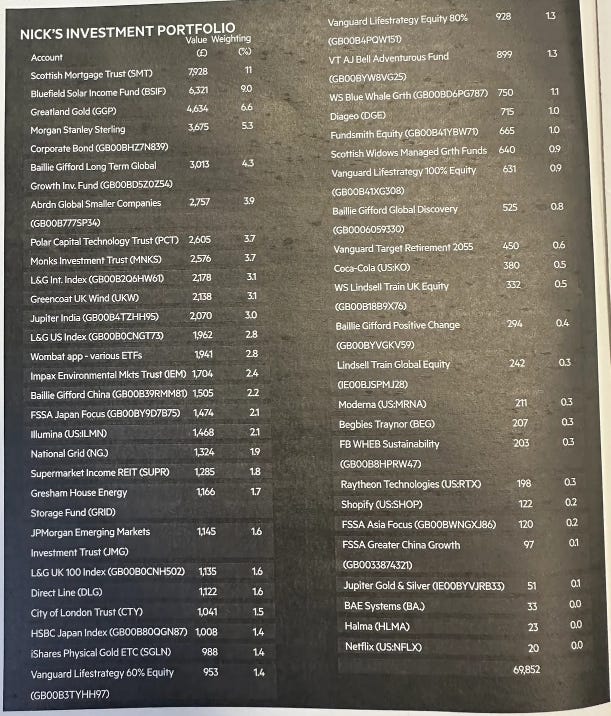

Diversification also easily becomes di-worsification: buying something just for the sake of buying it to be diversified. As opposed to investing in a few companies and really understanding them. If you have 30 good investment ideas, why not buy the best 5 or 10 rather than investing in ideas 20-30 just for the sake of being diversified?

The 10-15 figure above is just my own personal preference and there’s no “right” number of stocks to hold, it’s largely just how many you feel comfortable owning.

Conclusion

Warren Buffet, Bill Ackman and Peter Thiel are some of the most successful investors of our time, all three are critics of diversification, and for good reason.

If you think you can understand a business and that it will be successful, there’s no need to put your money into one that you think is worse just to “be diversified”. Of course, investing in ETFs is a form of diversification but like all diversification, it will build over decades rather than in years.

“Diversification is protection against ignorance. It makes little sense if you know what you are doing.” — Warren Buffet

In my opinion, diversification is largely a hedge against laziness. There’s no problem with diversification and it is an effective means of maintaining one’s wealth. But if you want to build wealth, investing in I’ve found to be investing in 5-15 well-managed businesses that you can understand is a far more effective way.

If you’re willing to do the research into a business and think it’s a good investment, there’s no reason not to allocate a large percentage of your portfolio to it, especially if you’re trying to build wealth.

Of course, there are always black swan events that can occur no matter how much research you do but these just have to be accepted as a part of investing and life.

Pros:

Reduces your chance of big losses.

Good for investors who don’t want to do loads of research.

Can protect against unforeseen black-swan events.

Cons:

Reduces your chance of big gains.

Arguably unnecessary for those willing to do a lot of research.

Can create a false sense of security.

If you enjoyed this article, subscribe and share it below!

Thanks for reading,

Harry 😊

Yes, concentration can be better for building wealth, for example, successful startup founders or going all in on NVDA, but the increased level of risk can't be ignored. That being said, it's up to the investor to do their research and decide if they are comfortable with taking the risk.

Diversification (=index funds) is the way to go for most retail investors. Unfortunately, they focus on the wrong things when analyzing public companies, e.g., ratios. Just to be clear about WB, the man himself is diversified. I saw a list of Berkshire Hathaway's holdings as of the middle of November '23, there were 45 stocks in there. That's not concentration.